Here is a clearer and easier-to-follow step-by-step instructions for understanding the Pag-Ibig housing loan and its application process:

Introduction

- Many Filipino families dream of having their own house.

- However, a significant number of Filipinos struggle to turn this dream into a reality.

- The 2020 Annual Poverty Indicator Survey of the Philippine Statistics Office revealed that only 59.8% of families in the Philippines own a house and lot.

The Pag IBIG Housing Loan

- The Pag IBIG Fund, also known as the Home Development Mutual Fund (HDMF), was established to address the housing needs of Filipino workers.

- It serves as a national savings program and provides affordable housing financing.

- Pag IBIG is a government agency that not only offers housing loans but also provides higher interest rates on savings compared to most banks.

- Pag IBIG savings can serve as collateral for various loans, including housing, calamity, and multi-purpose loans.

- Filipinos typically consider two options for housing loans: Pag IBIG Fund and banks.

- Each option has its pros and cons, and the final decision should be based on personal criteria.

- Factors to consider include qualifications, loanable amount, interest rate, loan term, and miscellaneous fees.

Pag IBIG Housing Loan vs. Bank Housing Loan

Qualifications

- Pag IBIG housing loans are available only to Pag IBIG members, while banks usually require proof of income or employment.

- Minimum wage earners have a higher chance of approval with Pag IBIG’s Affordable Housing Loan Program.

Loanable Amount

- Pag IBIG offers housing loans up to ₱580,000 for socialized housing and up to ₱750,000 for socialized condominium units.

- Regular applicants with above-average income can borrow up to ₱6 million.

- Banks typically have a minimum loanable amount of ₱300,000, with the final amount depending on the provider’s criteria.

Interest Rate

- Pag IBIG housing loans have lower interest rates, starting from 3% for low-income earners and 5.75% for regular borrowers in a 1-year fixed pricing period.

- Banks offer housing loans with interest rates ranging from 5.25% to 6.75% for the first year.

- Pag IBIG’s interest rate is capped at 2% per annum by law, while banks have no specific ceiling.

Loan Term

- Pag IBIG allows borrowers to choose a loan term of up to 30 years.

- Banks offer loan terms ranging from 20 to 25 years, depending on the purpose of the loan.

- Miscellaneous Fees

- Pag IBIG guarantees minimal fees, including a ₱1,000 processing fee and a ₱2,000 fee before loan release.

- Banks may charge additional fees such as appraisal fees, handling fees, notarial fees, doc stamps tax, and registration fees.

Benefits of Pag IBIG Membership

- Pag IBIG members can keep their contributions in a savings account.

- Even if not availing of a housing loan, the savings can earn dividends over time.

- The money remains in the account until the end of the 20-year membership period.

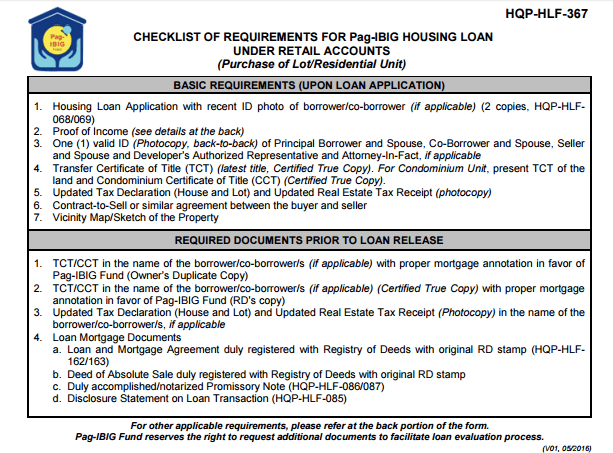

Pag IBIG Housing Loan Requirements

Upon Loan Application:

- Pay a ₱1,000 processing fee and a ₱2,000 appraisal fee.

- Fill out the Housing Loan Application Form and attach a recent ID photo.

- Provide proof of income, depending on employment status.

- Submit a photocopy of a valid ID.

- Prepare necessary documents like the Transfer Certificate of Title, Tax Declaration, and Real Estate Tax Receipt.

- Include additional requirements if applicable,

How To Apply for Pag IBIG Housing Loan: A 7-Step Guide to Getting Approved

Step 1: Check your eligibility

- Make sure you are an active Pag IBIG Fund member with at least 24 months of contributions.

- If you are a new member, you can complete the required contributions through lump-sum payments.

- Ensure that you meet the age requirements: not more than 65 years old at the time of application and not more than 70 years old at loan maturity.

- You should have a legal capacity to acquire and encumber real property.

- Pass the background checks conducted by the Pag IBIG Fund.

- You should not have any previous Pag IBIG housing loans that ended up with foreclosure, default, cancellation, or surrender.

- If you have an existing Pag IBIG housing loan or Short Term Loan, make sure your payments are updated.

Step 2: Determine your purpose for the loan

- The Pag IBIG housing loan can be used for various purposes, including buying a lot, house and lot, or condominium unit, building or renovating a residential unit, refinancing an existing loan, or acquiring Pag-IBIG acquired assets.

- Different loan combinations are available depending on your needs.

Step 3: Choose the loan program that matches your income level

- Pag IBIG offers different loan programs based on your capacity to pay.

- The Affordable Housing Loan Program is for low-income earners, while the Regular Housing Loan Program is for applicants with above-average gross monthly income.

- There is also the Pag-IBIG Home Equity Appreciation Loan (HEAL) for members with good payment records, and the Pag-IBIG Acquired Assets Program for purchasing foreclosed properties.

Step 4: Gather and complete the necessary requirements

- Make sure you have all the required documents and fees ready.

- The requirements may vary depending on the purpose of the loan.

Step 5: Submit the requirements to Pag IBIG

- You can submit your application online through the Virtual Pag-IBIG portal or apply in person at the nearest Pag IBIG branch.

- Follow the instructions and provide the necessary information.

- If applying online, you will receive a reference number and appointment schedule.

- If applying in person, submit the application form and requirements, pay the processing and appraisal fees, and receive the Housing Loan Application Acknowledgement Receipt.

Step 6: Wait for the loan approval

- Pag IBIG will notify you about the status of your application within 17 days.

- If approved, you will receive a Notice of Approval (NOA) and Letter of Guaranty (LOG).

- Arrange a visit to the Pag IBIG office to sign the loan documents.

- Fulfill any additional requirements specified in the NOA.

Step 7: Complete the NOA requirements for check release

- Follow the provided checklist based on the purpose of your loan.

- This may involve payments, transfers, and submission of documents to different agencies.

- Make sure to complete the requirements within 90 days to receive the loan check.

By following these steps, you can apply for a Pag IBIG Housing Loan successfully.