Once again, the Union Bank of the Philippines finds itself in hot water as its website, ATMs and online app remain inaccessible for an extended period, leaving over 5 million customers seething with anger and frustration.

The bank’s failure to timely rectify the situation, which has lasted for two consecutive days and possibly even longer, has cast doubt on its reliability and competence as a financial institution.

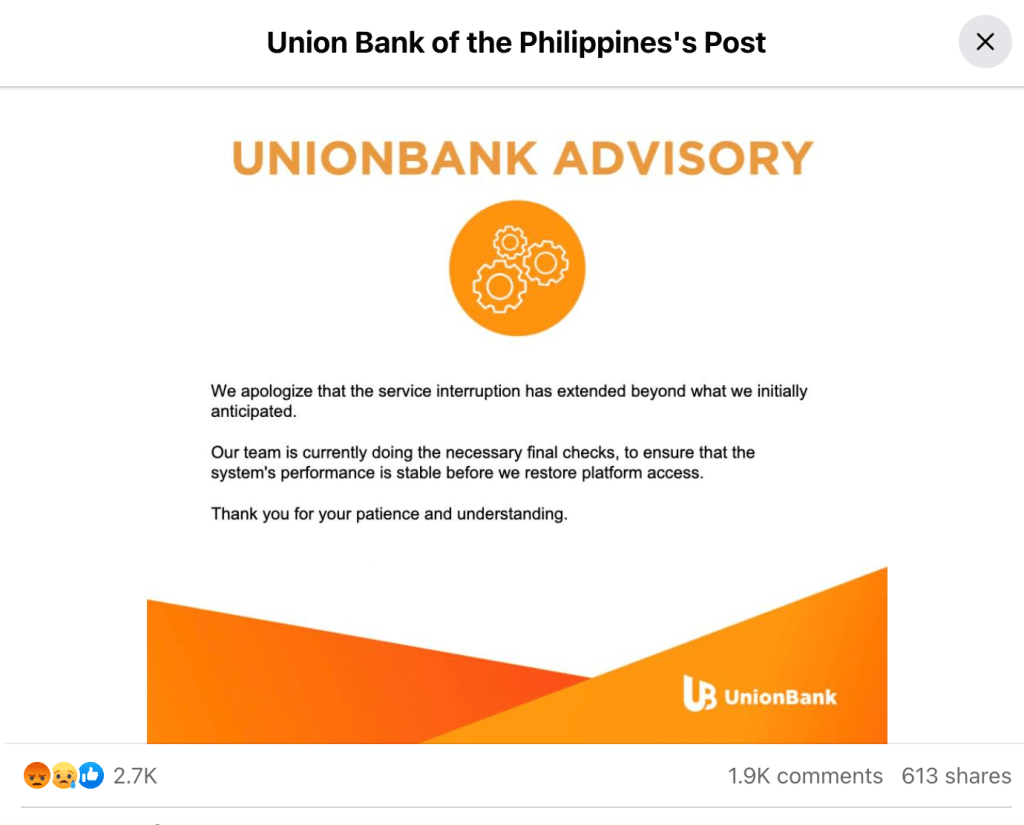

The bank’s Facebook page has become a battleground of discontent, with an advisory issued by Union Bank only fueling the fire of customer outrage.

Within hours, the advisory was bombarded with over 1,400 angry emojis and more than 1,800 comments expressing disappointment and dissatisfaction. In a feeble attempt to address the matter, the bank’s advisory states, “We apologize that the service interruption has extended beyond what we initially anticipated,” further highlighting the protracted disruption and the bank’s inability to meet customer expectations.

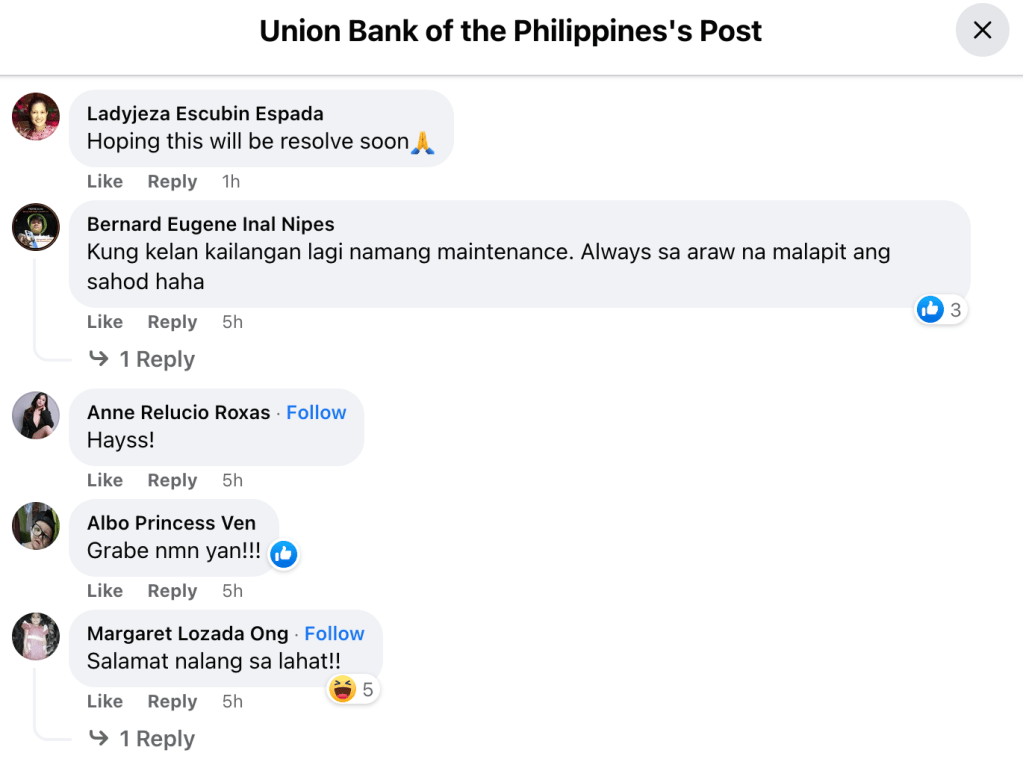

Customers and frustrated netizens have taken to various social media platforms to vent their displeasure, criticizing Union Bank for its subpar service and its failure to provide timely updates regarding the ongoing service interruptions. The bank management’s delayed response in issuing an advisory, more than 24 hours after the system and app outage began, has only intensified customer frustration.

An inspection of Union Bank’s Facebook page reveals a deluge of complaints from customers who encountered issues with the non-functional app just the day before.

One disgruntled customer exclaimed, “Down pa din ang app niyo until now? Still can’t access eh RN,” clearly expressing their mounting exasperation. Another customer highlighted the bank’s recurrent downtime problems, stating, “Your online banking always has a problem, and the display of our account balance is always delayed.”

Regrettably, the bank’s attempts to quell the storm with two advisories issued within an hour of each other have done little to pacify the ire of its already inconvenienced customers. Mila Francisco, unafraid to mince words, went as far as urging others to withdraw their money, stating, “Widthraw nyo na laman ng ATM niyo. Irap sa online nila. Ka-stress.”

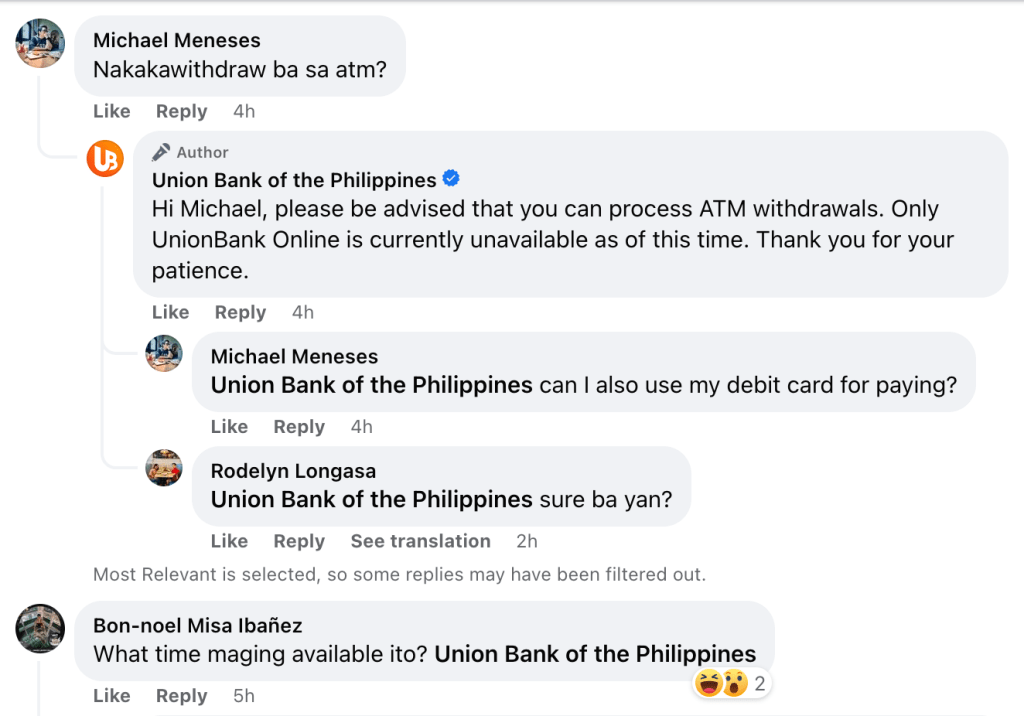

To compound the situation, both Union Bank’s online app and ATMs have been rendered inoperable due to the ongoing “system maintenance,” leaving millions of customers unable to conduct online transactions, payments, or even basic ATM activities.

Reports and comments have surfaced, indicating intermittent issues with ATMs since the outset of the outage issue. However, a recent Facebook update from the bank conveyed that ATMs were finally functioning, while the online portal “is currently unavailable as of this time.”

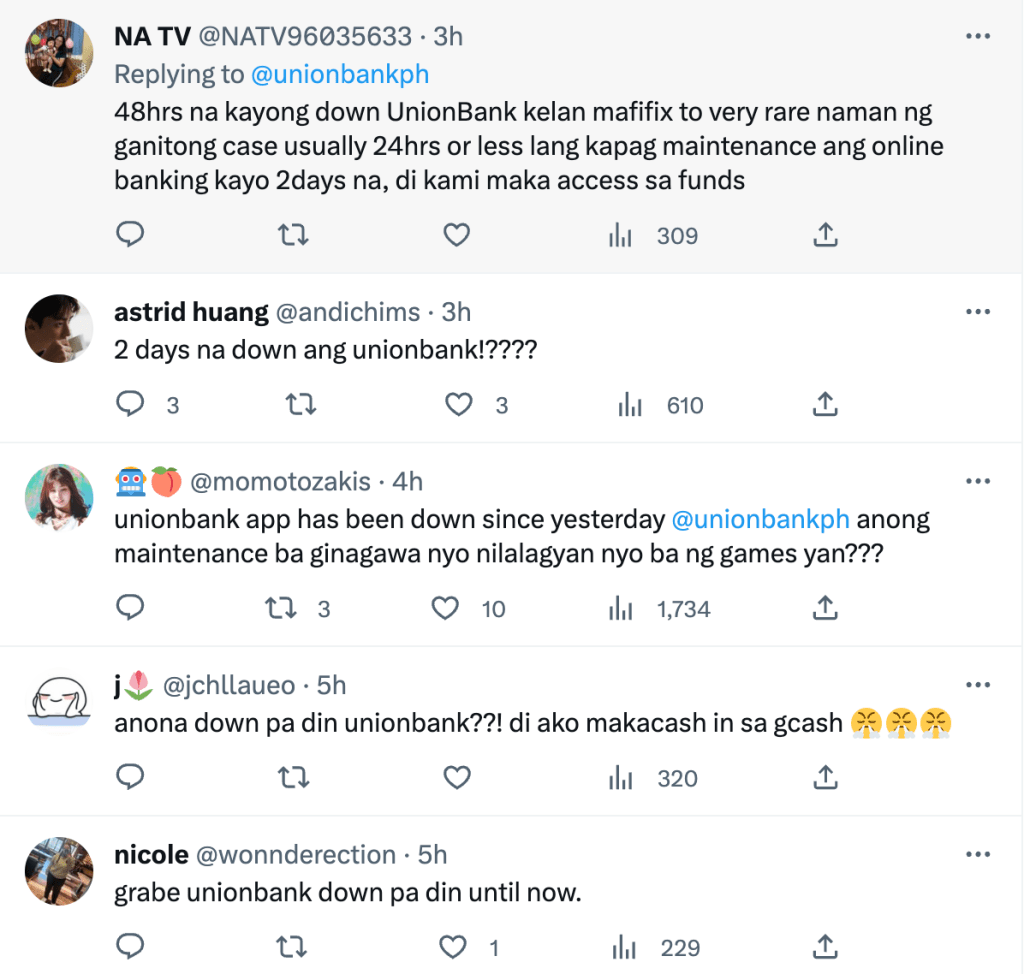

On Twitter, disgruntled Union Bank customers have also taken to the platform to voice their disappointment over the past two agonizing days.

One user, Bianca Azurin, expressed her exasperation, tweeting, “Why isn’t anyone talking about the fact that Union Bank app has been down the whole freakin’ day?”

Adding insult to injury, Union Bank’s affiliation with PAG-IBIG, a government-owned corporation, has wreaked havoc on thousands of PAG-IBIG members who were eagerly anticipating their loan transfers to the bank. Unfortunately, the ongoing system maintenance has left them in a state of limbo, with no resolution in sight.

Despite mounting pressure from customers to regain access to their online accounts, Union Bank has failed to provide an estimated timeframe for resolving the persistent system issues.

It is crucial to recall that the Bangko Sentral ng Pilipinas (BSP) had previously sanctioned Union Bank and BDO for a cybersecurity breach that impacted 700 BDO clients. The BSP’s investigation, concluded after three months, identified a “compromised web service” and unauthorized access to BDO accounts, with the majority of fund transfers being directed to Union Bank.

As Union Bank’s ongoing system outage continues to paralyze operations, millions of customers find themselves trapped in a frustrating and inconvenient situation.

The bank’s inability to address and rectify the issue swiftly has raised concerns about its commitment to customer service and cybersecurity. Only time will tell when Union Bank’s services will be fully restored, providing relief to its exasperated clientele.