Have you ever wondered what happened to Union Bank and BDO after the news broke in April 2022 that the BSP had issued sanctions against them? Were they truly sanctioned, or did the Aboitiz-led Union Bank merely receive a slap on the wrist? Find out right here…

As the Union Bank faces public backlash for its poor service and frequent system outages, questions arise about the sanctions imposed by the Bangko Sentral ng Pilipinas (BSP) following the hacking incident in December 2021.

With a history of controversies and recent inconveniences faced by millions of customers, questions arise about the actions taken by the BSP to discipline Union Bank and Bangko De Oro (BDO), both implicated in the hacking incidents that compromised approximately 700 BDO Unibank accounts, most of which had fund transfers bound for Union Bank accounts.

Surprisingly, no mainstream media outlets in the country have provided follow-up reports on the hacking issue, leaving the public searching for answers.

Even online searches using specific keywords such as “BSP sanctions against Union Bank and BDO” yield no relevant stories.

Consequently, the fate of the Aboitiz-led Union Bank and SM Group’s BDO remains unknown in terms of the disciplinary measures imposed by the BSP.

Before exploring the extent of the sanctions or the lack thereof, it is crucial to highlight the close relationship between Sabin Aboitiz, President and CEO of Aboitiz, the parent company of Union Bank, and President Bongbong Marcos.

The president and the tycoon are known as ‘kumpadres’ or closed friends, and this connection becomes more significant as it was revealed that Sabin holds influential positions within the Private Sector Advisory Council and the APEC Business Advisory Council.

Furthermore, the appointment of other Aboitiz executives to key government posts following BBM’s inauguration raises questions about the influence enjoyed by the Aboitiz conglomerate under the current administration. This includes a Union Bank’s chief tech officer who was tapped by Sabin to work for the Marcos administration in January.

Based on the facts presented, one can speculate about the severity of the sanctions or penalties imposed on Union Bank and BDO in April 2022.

News reports during that period indicate that the BSP provided no specific details about the punishments, merely emphasizing the importance of enhancing risk management systems involving cybersecurity, anti-money laundering, and counter-terrorism and proliferation financing.

However, our online investigation yielded screenshots that point to Union Bank receiving a mere slap on the wrist.

On May 26, 2022, the Security and Exchange Commission (SEC) ordered both Union Bank and BDO to disclose the nature of the sanctions imposed by the BSP, their impact on the banks’ business, financial condition, and operations, as well as the investigation’s status.

A closer look at the available information suggests that Union Bank received minimal repercussions for its involvement in the hacking incident. Union Bank’s response indicated that no monetary sanctions were imposed, asserting that the the BSP’s sanctions had no material impact on the bank’s overall operations.

“There is no material impact on the business, financial conditions or the operations of UnionBank. Lastly, the examination/ investigation of the BSP has been concluded,” the bank states.

Conversely, BDO chose to remain silent, citing their inability to provide further details while expressing commitment to collaborating with the BSP to ensure a more secure banking environment. The bank simply stated that they “will work with the BSP to ensure a more secure banking environment.”

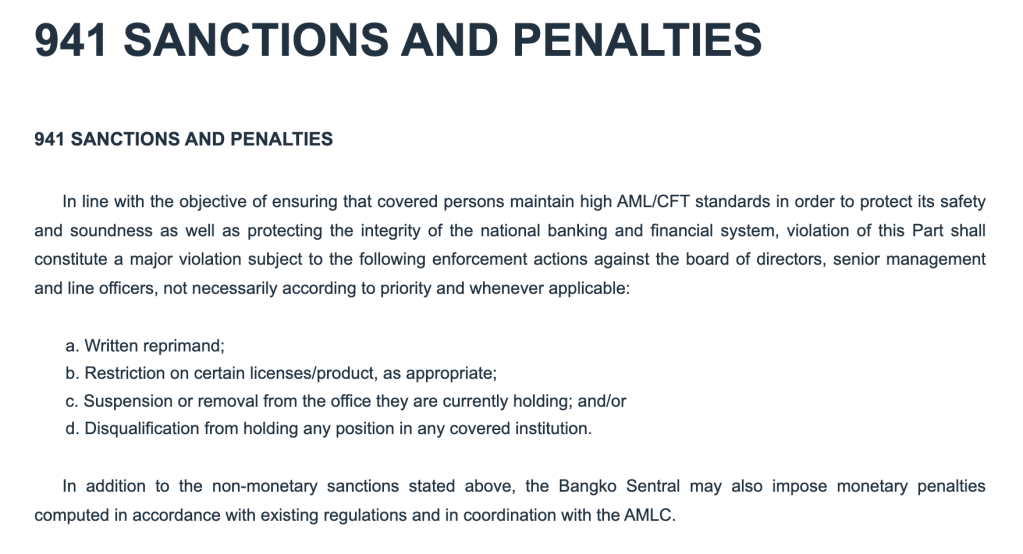

The Union Bank’s disclosure, combined with the Aboitiz conglomerate’s apparent influence within the BBM administration, hints at the possibility of non-monetary sanctions imposed by the BSP. While exact details remain undisclosed, non-monetary sanctions can include written reprimands, license restrictions, suspensions, and disqualification from holding positions in covered institutions. Such leniency raises questions about the role of connections and influence in shaping outcomes and accountability in the banking sector.

Drawing from the BSP’s 941 Sanctions and Penalties framework, it’s reasonable to assume, based on Union Bank’s response, that they may have faced a written reprimand. But what does this all mean?

Well, my friends, it appears that the power of connections and influence cannot be underestimated. It seems that knowing and rubbing shoulders with the right people in high places can yield favorable outcomes.

Union Bank, with its close ties to influential figures, seems to have emerged from the hacking incident relatively unscathed. While the full extent of the sanctions remains shrouded in secrecy, one thing is clear: the story of Union Bank and its connection to political powerhouses is a tale that continues to intrigue and astonish.

As customers continue to question the impact on their banking experience and the effectiveness of risk management systems, the role of connections and influence cannot be ignored. The story serves as a reminder that certain affiliations can yield significant advantages, potentially shaping outcomes and accountability within the banking sector.