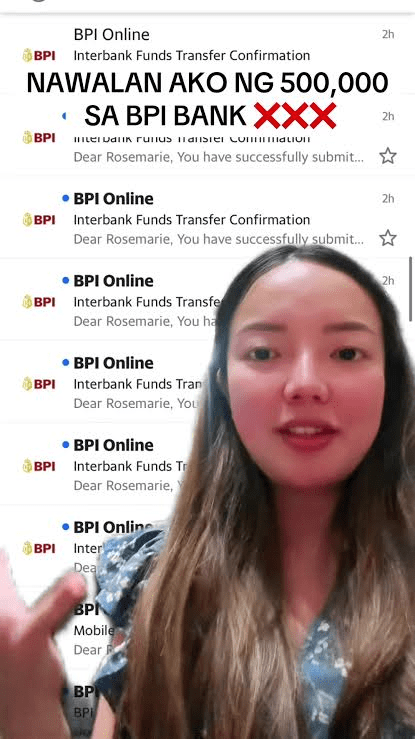

In a recent social media uproar, self-claimed CEO and social media personality Rosmar Tan expressed shock at discovering an unexpected drain on her BPI account.

“Akala ko ba secured sa BPI? Anyare?” (Wasn’t my BPI supposed to be secure? What happened?), Rosmar queried in disbelief.

Apparently, the phone number linked to her online banking was inexplicably altered for reasons unknown.

According to her, her online bank was registered on a Flare 7 device, which allegedly transferred a hefty sum of P500,000 to Eastwest Instapay. This seemed implausible to Rosmar since she’s using an iPhone 15 Pro Max.

When she attempted to log into her account, it was already disabled, and she found herself unable to reset it due to a different registered number.

Adding to the puzzle, Rosmar stated, “Nung tumawag ako sa hotline. meron daw akong ATM card, which is never kong nakuha kasi checking account ko ‘yan tapos panay pang ako online banking.”

However, according to BPI, her ATM card had been closed, an assertion Rosmar refutes, insisting she never had one.

“Never ko nakuha sa BPI BRANCH OF ACCOUNT KO?” (I never picked it up from my BPI branch of account), she affirmed.

BPI San Pablo claimed they don’t deliver ATM cards and that they’re strictly for pick-up.

“Sinong nag-pick up? kung ‘di ko na-pick up? Sinong gumamit? Sabi ng hotline ng BPI ang only chance lang daw na mapalitan ang cellphone number na naka-link sa online banking is yung ATM card. so meaning nakanino ang ATM card ko?” (Who picked it up if I didn’t? Who used it? According to BPI hotline, the only chance to update the linked cellphone number in online banking is through the ATM card. So, whose possession is my ATM card in?), Rosmar lamented.

Rosmar issued a stern warning to whoever might be responsible for the withdrawal, threatening to ensure their imprisonment.