Several e-wallet accountholders made their way to the National Bureau of Investigation (NBI) on Thursday, February 1, reporting a surge in unauthorized transactions siphoning off tens of thousands of pesos.

Victims, predominantly PayMaya accountholders, expressed dismay over the sudden disappearance of their hard-earned money from online bank accounts, asserting they had not initiated any transactions.

Maya, a Filipino financial services and digital payments company based in Metro Manila, reportedly assured its customers they’re currently conducting an investigation into the matter, according to ABS-CBN News.

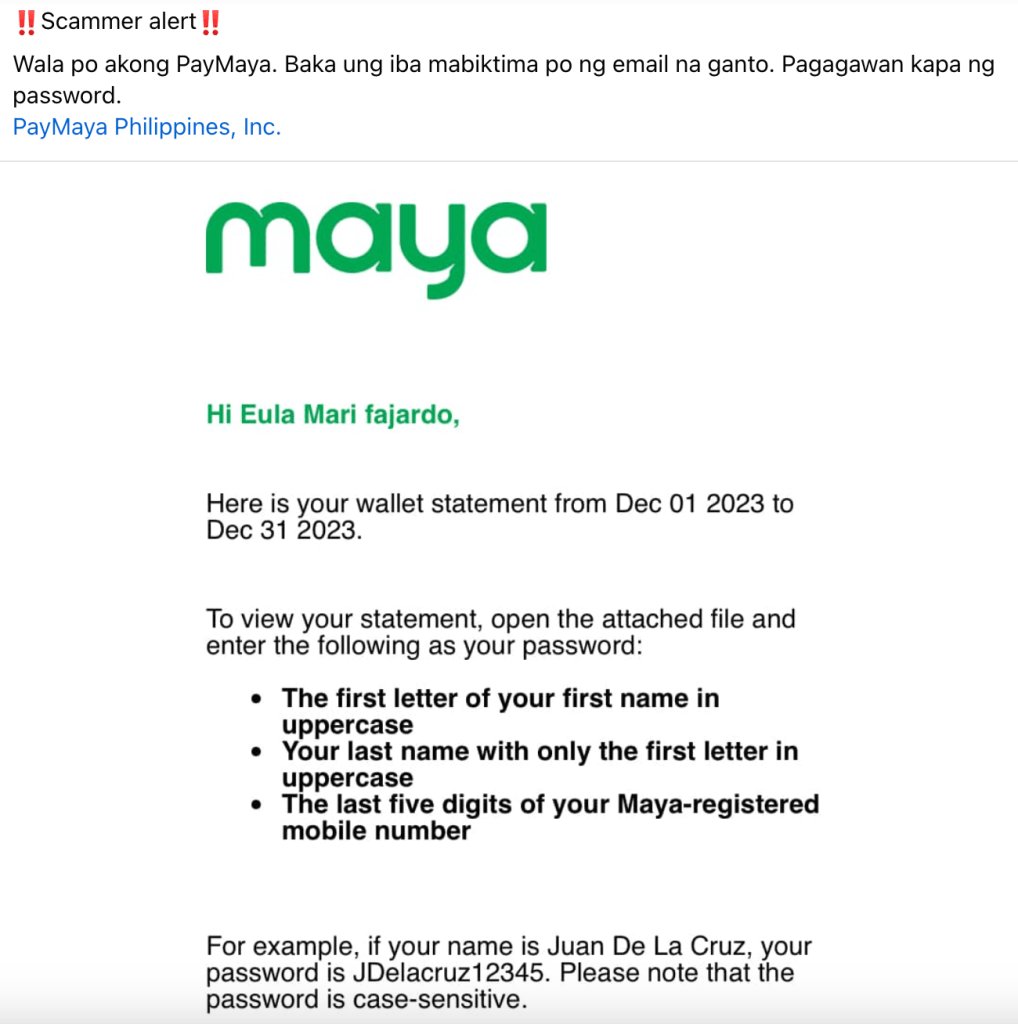

In response, distressed netizens took to Facebook, revealing phishing emails supposedly from Maya that urged recipients to create new passwords, exploiting fears of compromised security.

Adding to the ordeal, a number of PayMaya users reported app downtimes over the past few days, compounding concerns over the security of their financial data.

GCash, another popular e-wallet system, faced a similar plight as its users reported unauthorized transactions to the NBI.

John Bansil, a cancer patient undergoing treatment, disclosed the disappearance of P10,600, funds earmarked for chemotherapy on the GCash app.

“Walang OTP, walang text. Hindi rin po pwedeng sabihing human error. Hindi naman po napalitan yong PIN namin eh,” expressed Bansil, underscoring the perplexing nature of the unauthorized transactions.

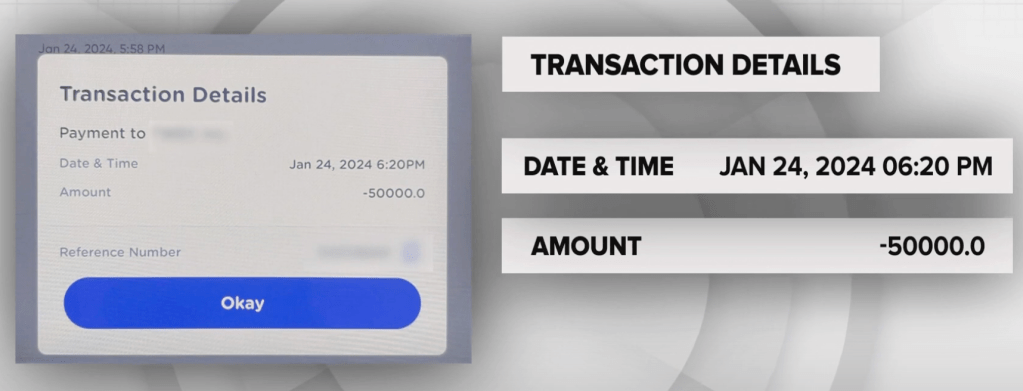

Ana Marie Dulalia, another GCash customer, recounted losing P50,000, which was mysteriously rerouted to the same merchant that received Bansil’s vanished money.

“Na-shock ako. Kasi pambayad ko yon ng bills. Pam-business ko po yon,” lamented Dulalia.

At least 10 e-wallet accounts reportedly sent unauthorized transactions to a suspected scam merchant’s account, raising alarms about the vulnerability of such platforms to hacking and illicit financial activities.

Law enforcement agencies advise against depositing substantial savings in e-wallet accounts due to the inherent risk of hacking and unauthorized transactions.

In response to the escalating issue, GCash has entered into a Memorandum of Agreement (MOA) with the NBI to fortify their joint efforts in combatting scams within the platform.

The agreement mandates GCash to share information about reported criminals’ e-wallet details with the NBI, enabling a collaborative crackdown on online fraud, PhilStar reported.

Oscar Reyes Jr., president and CEO of GCash operator G-Xchange, highlighted the importance of the partnership, emphasizing the need for cooperation with other institutions.

The collaboration aims to empower the NBI to investigate suspicious activities and prevent fraudulent transactions promptly.

GCash, which boasts over four million accounts dismantled due to malicious activities from January 2022 to June 2023, believes that collaborative measures enforced by both the government and the platform contributed to a decline in fraudulent activities.

The government’s stringent regulations for owning mobile numbers and GCash’s introduction of additional security features have played a pivotal role in safeguarding consumers from digital threats.

Reyes emphasized that the ongoing collaboration with the NBI is crucial in tackling evolving digital fraud patterns, ensuring the security of e-wallet users in the Philippines.

GCash, owned by Mynt (Globe Fintech Innovations Inc.) and managed by G-Xchange, remains the largest finance app in the country, offering a comprehensive range of financial services from cash transfer to quick loans.